Independent Investment Manager

The independent investment manager of Gaoyu Securities Limited partnered with many global private banks, with a management policy that puts you first.

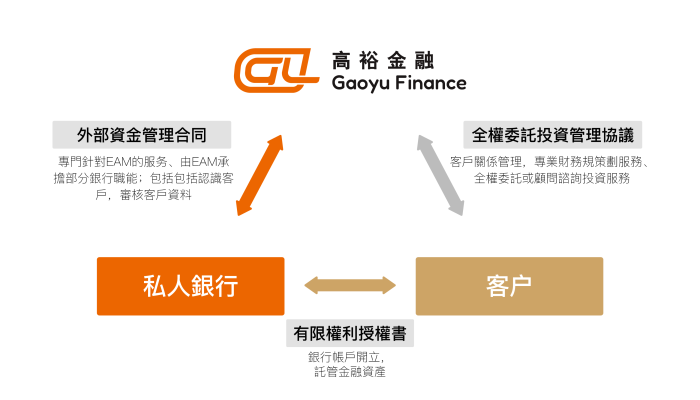

External Asset Managers (EAM) are the main form of supplementing the private banking industry. Compared with traditional private banks, EAM is independent from the banking system. It is customer-centered and provides investment advice and wealth management solutions that are more personalized, more flexible, and more independent. As a third-party platform, EAM forms a tripartite contractual relationship with customers and private banks. Customers entrust EAM with full authority to manage the assets of their private banks, and private banks, as asset custodians, ensure the security of customer assets.

Customer-centric

The starting point and goal of the EAM platform are the needs and interests of customers. It is not profit-driven by product sales or transaction commissions, and is not limited to one bank. It provides customers with the most suitable solutions by integrating the superior products and services of different banks from a neutral and objective perspective.

Customers only need to use EAM as a unified service window to communicate with different private banks and investment banks, truly realizing the diversified management of assets across regions and multiple banks.

Funds security and privacy protection

EAM must operate under a regulatory framework and does not hold any client assets. Client assets are always held in private bank accounts chosen by clients, and the security of funds is fully guaranteed. Under the EAM model, the bank’s KYC process for customers is relatively simple, and customers do not need to face different RMs from multiple banks at the same time, which is conducive to protecting their privacy.

Efficient communication and cost savings

EAM covers multiple banks at the same time, receives comprehensive information, and is familiar with industry practices. It can greatly save customers’ time and energy in communicating and weighing one by one under the traditional private banking model. At the same time, EAM has stronger bargaining power than individual customers and can bring customers together. Pay all external fees to a minimum.

Independent and professional management mode

Assess customers’ risk criteria and investment objectives, flexibly select the best institution according to customer needs and circumstances, diversify custody assets, financing loans, fund investments, etc., provide customers with independent investment advice and financial consulting services, and assist customers in understanding and participating in various types of We provide timely warnings to customers about the latest developments in products and services, and can also assist customers in making buying and selling decisions.